1. Introduction

Families with significant wealth would naturally wish to have the means to manage their financial affairs which align with the family’s interests, goals and values. It has gradually become the norm for such affluent families to set up single family offices (“SFO(s)”), which essentially refers to a legal entity created to exclusively manage the assets, investments and long-term interests of a single ultra-high net worth (“UHNW”) family. Unlike a multiple family office which manages the wealth of multiple families, a SFO focuses solely on one family’s needs.

2. Regulatory requirements of a SFO in Malaysia

Generally, it is provided under the Capital Markets and Services Act 2007 (“CMSA”) that a person carrying out any of the following regulated activities is required to obtain a capital markets services licence from the Securities Commission Malaysia (“SC”):

- Dealing in securities;

- Dealing in derivatives;

- Fund management;

- Advising on corporate finance;

- Investment advice;

- Financial planning;

- Dealing in private retirement schemes; and

- Clearing for securities or derivatives.

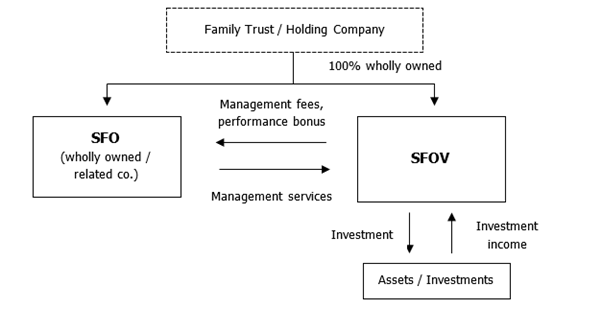

The nature of a SFO typically involves the carrying out of certain regulated activities such as fund management or financial planning. Notwithstanding, the SC had on 23 September 2024 clarified via its media release and FAQ that a SFO may be exempted from such licensing requirements if the SFO can demonstrate that the regulated activities undertaken are for the benefit of a single family office vehicle (“SFOV”), which is a related corporation of the SFO.

To constitute a SFOV, it must be established solely for the purposes of holding the assets, investments and long-term interests of members of a single family, and must be wholly-owned or controlled by that single family. A “single family” is clarified by the SC in the FAQ to mean individuals who are lineal descendants from a single ancestor, including the close relative of the individual.

The diagram below is an illustration of the relationship between an SFO and an SFOV:

Notwithstanding the exemption, the SC may still impose terms and conditions on the SFO pursuant to Section 58 of the CMSA.

3. Malaysia’s Single Family Office Incentive Scheme

The SC’s media release on 23 September 2024 further outlines the conditions for the single family office incentive scheme (“SFO Scheme”). Under the SFO Scheme, eligible SFOVs may enjoy a 0% concessionary tax rate on income generated by eligible investments for a period of 10 years (“Initial Period”) which may be extended for an additional 10 years (“Additional Period”).

The following conditions must be fulfilled in order for a SFOV to qualify for the 0% tax incentive under the SFO Scheme:

(a) Location: The SFOV must be established and operating in Pulau 1, Forest City Special Financial Zone.

(b) Duration for the 0% tax incentive: A total of 20 years, including the Initial Period and the Additional Period.

(c) To qualify for the Initial Period:

- The SFOV must be a new investment holding company incorporated in Malaysia and must seek pre-registration with the SC on its eligibility for the tax incentives under the SFO Scheme.

- The SFO, which must be a related company of the SFOV, must be set up and operated out of Pulau 1, Forest City Special Financial Zone with at least one investment professional having a minimum monthly salary of RM10,000.

- The SFOV must hold assets under management (“AUM”) of at least RM30 million and meet the minimum local investment in eligible and promoted investments of at least 10% of AUM or RM10 million, whichever is lower.

- The SFOV must incur a minimum operating expenditure (“OPEX”) of RM500,000 per annum locally.

- The SFOV must employ a minimum of two full-time employees of whom at least one is an investment professional, with a minimum monthly salary of RM10,000.

(d) To qualify for the Additional Period:

- The SFOV must hold AUM of at least RM50 million and meet the minimum local investment in eligible and promoted investments of at least 10% of AUM or RM10 million, whichever is higher.

- The SFOV must incur a minimum OPEX of RM650,000 per annum locally.

- The SFOV must employ a minimum of four full-time employees.

4. SC’s Role in the SFO Scheme

According to SC’s media release, SFOVs may apply to the SC for certification of compliance with the relevant conditions for purposes of the tax incentives.

The SC is currently working with the relevant stakeholders to operationalise the SFO Scheme by first quarter of 2025. The detailed conditions will be made available by then on SC’s website https://www.sc.com.my/development/single-family-office.

Interested SFOVs are encouraged to check the website regularly for updates.

5. Perspective

The introduction of the SFO Scheme represents a pivotal development in positioning Malaysia as a desirable hub for wealth management, especially for affluent families across the region. While Singapore has long been the favoured destination for family offices, as evidenced by its remarkable success in attracting 250 new single-family offices in the first eight months of 2024[1], Malaysia could present an intriguing alternative. As Forest City is located just miles away from Singapore, it will be interesting to observe whether the SFO Scheme will lure UHNW families to consider Malaysia as a viable alternative for their family office needs. The competitive advantage may hinge on the detailed conditions soon to be issued by the SC, which are expected to clarify the scope of “eligible investments” for the tax incentive and what constitutes “eligible and promoted investments” for local investment. These clarifications will be crucial in shaping Malaysia’s competitiveness in the family office landscape.

[1] “Building a Stronger Tomorrow: Family Offices in our Flourishing Wealth Management Landscape” – Speech by Mr Chee Hong Tat, Minister for Transport and Second Minister for Finance, and Deputy Chairman of the Monetary Authority of Singapore, at the Global-Asia Family Office Summit on 16 September 2024

This legal update is for general information only and is not a substitute for legal and tax advice.

Published on: 14 October 2024

Should you have any queries as to how these developments affect your business, please do not hesitate to contact us.

This article was co-authored by Yau Khai Ling, Lau Yuet Sian and Chan Yi Ling.

Yau Khai Ling

Principal Partner

E: ykl@khailinglaw.com

Lau Yuet Sian

Partner

E: lys@khailinglaw.com

Chan Yi Ling

Senior Associate

E: cyl@khailinglaw.com